For the 70% other tools don't touch.

Other tools automate the last 20-30% — templates, validation, approvals and posting. The first 70-80%? Still spreadsheets. Still emails. Still the same people staying late every close.

Finance Automation by Redwood orchestrates journal entry creation from data acquisition to SAP posting. No gaps. No handoffs.

Where does your journal effort actually go?

Finance Automation handles both sides of journal execution by creating and posting.

Your choice is whether to coexist with current tools or replace them.

This isn't a future problem. It's a now problem.

The urgency isn’t hypothetical — it’s already here.

Three forces are converging now, and manual journal processes won’t survive any of them.

-

S/4HANA deadline

December 2027

ECC mainstream support ends. Only 32% have transitioned. If you’re migrating anyway, why replicate manual journal processes in a new system?

-

Talent crisis

17% fewer accountants

Since 2019. 75% of CPAs are expected to retire within the next 15 years. 99% report burnout. You cannot hire your way out of manual processes.

-

Audit pressure

2x control findings

Journal entry control issues doubled as a percentage of material weaknesses (2019-2023). Manual processes are a control risk that’s easily removable.

Get one tool that does what other tools can't. And what they can.

Other tools assume someone has already done the hard work. Finance Automation does the hard work.

Your choice: Finance Automation can post directly to SAP or output journals to your environment. Either way, you remove the manual prep that slows teams down.

Journal entry features

Journal entry automation only works if it solves the right problems. These features go beyond templates and posting. They target the root causes of effort, delay, risk, errors and rework.

-

Rule-based automation

Leverage intelligent automation to handle large volumes of financial data with precision and efficiency. Achieve 60–75% reduction in your organization’s journal processing time.

Rules apply consistently, so there’s no spreadsheets and no second-guessing.

-

Audit readiness

Every journal is created, validated, approved and posted from a single, governed system.

Data, logic and supporting evidence are captured automatically during execution to give auditors a complete, time-stamped trail without reconstruction or follow-up.

-

Automated approvals

Approvals are orchestrated as part of journal creation — not bolted on afterward.

Routing, thresholds and escalations are applied automatically based on rules, so journals move forward without emails, manual chasing or late-stage surprises.

Stop documenting controls. Start enforcing them.

Most journal controls are detective — pieced together after posting from emails, spreadsheets and approval chains. That’s not control. That’s archaeology.

Finance Automation enforces controls during execution. Rules are applied during journal creation, and each step is recorded automatically. Auditors see what happened because the system did it — not because someone reconstructed it.

- Preventive, not detective

- Execution creates a record, so there’s no need to piece it together later

- SOX-ready because the process is governed, not because you documented it

They reversed it. So did these organizations.

621% three-year ROI (IDC) • 60-75% reduction in journal processing time • 58% fewer material errors

-

32,000 journals

per month80% now automated

1,300 end users -

45,000 hours

saved annuallyRatio reversed

80% analysis, 20% data work -

100,000 hours

saved in 20244-day close

Global manufacturing scale

Built for orchestration. Not observation.

Journal entry automation isn’t just a posting problem. It’s an orchestration problem — connecting systems, executing logic, enforcing controls during execution and posting natively.

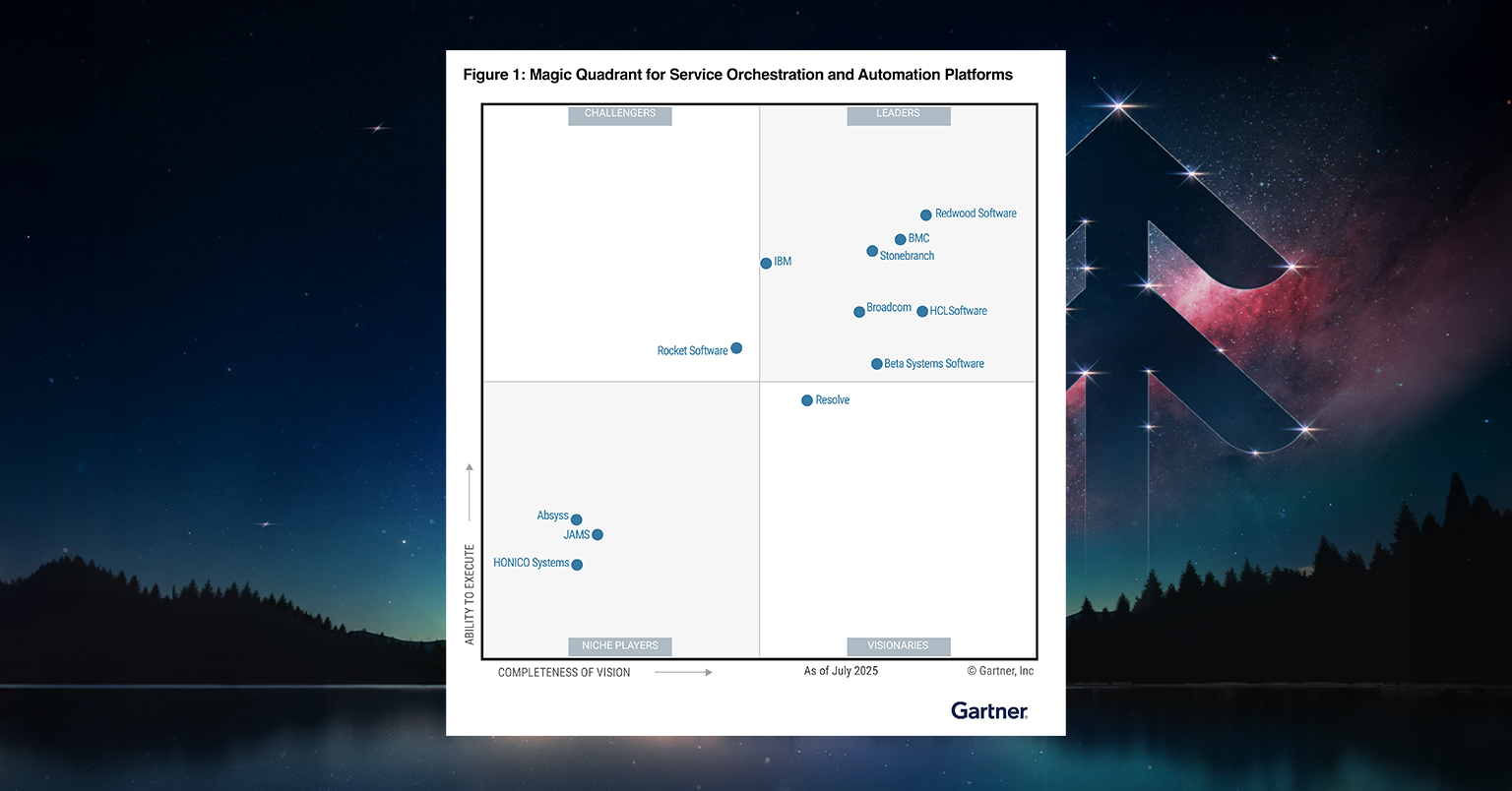

That’s exactly what service orchestration and automation platforms (SOAP) are built to do. And Redwood Software is a Gartner Magic Quadrant Leader in SOAP.

This isn’t a feature claim. It’s architecture. Observation-layer tools watch work happen. Orchestration platforms do the work.

What keeps you up at night?

These aren’t abstract concerns. They’re the questions finance leaders ask themselves every close. And they all point to the same root issue: the effort in manual journal processes are hiding in plain sight.

-

Controllers

"What if Sarah is out during close?"

Key-person dependency isn’t expertise. It’s fragility. Automate the tribal knowledge so the close doesn’t depend on who’s in the building.

-

R2R process owners

"We have tools. Why is it still manual?"

Because your tools automate posting, not creation. The spreadsheets, the data pulls and the email approvals — that’s still your team. Until now.

-

Heads of controls

"Another audit finding on journals"

Manual journals mean manual controls. Preventive beats detective. Enforce policy during execution — then there’s nothing to reconstruct.

Related solutions

Explore more Redwood Software solutions that eliminate manual work across the entire close.

-

Financial close automation

Financial Close ChecklistOrchestrate the entire close — manual and fully automated tasks, dependencies, reconciliations, journals and more — with full visibility and control.

-

Balance sheet reconciliation

Balance Sheet AutomationAutomate up to 98% of reconciliations using intelligent matching, line-item level analysis, exception handling and continuous audit readiness.

-

SAP finance automation

SAP Finance AutomationStreamline financial close activities across SAP ERP and S/4HANA with deep integration, full process orchestration and zero custom development.

FORVIA: 32,000 journals automated

80% automation across 1,300 users. Learn how FORVIA reimagined its finance operations at scale, across teams and without compromise.

Common use cases

Journal automation is built for everyday grind.

-

Adjusting and recurring journals

Depreciation, rent, payroll allocations and accruals

-

High-volume transaction

Real-time recording of intercompany postings or other routine entries

-

Month-end close

Streamlining period-end processes by removing manual work

How it works

With Finance Automation, the journal entry is fully orchestrated. Use the platform to handle every step, from data to posting, without the manual drag of spreadsheets, emails or rework.

- Data integration: Import data from internal/external sources (spreadsheets and other systems) via APIs or uploads.

- Rule-based processing: Preset rules (e.g., transformation, calculations) to generate entries for journal preparation.

- Validation: Check entries against live data for accuracy (e.g., valid accounts, cost centers) before posting.

- Workflow management: Route entries through automated, rule-based approval workflows.

- Posting: Automatically post approved entries to the general ledger (GL).

- Reversals: Accruals are automatically reversed the next period if applicable.

Go deeper

Still relying on spreadsheets and approvals? Explore more resources that unpack the real journal challenges and how full automation solves them.

Automated journal entries FAQs

What is the cost of manual journal entry processes?

Manual journal entry processes come with significant costs that are both seen and unseen for finance and accounting teams. These tasks are notoriously time-consuming and rely on outdated tools like Excel to post journal entries across multiple systems. This opens the door to manual data entry errors, discrepancies in financial records and inefficiencies that compound as transaction volumes grow. The lack of integration between accounting software and documentation sources forces teams to hunt down supporting documents, reconcile and validate data manually, without reliable internal controls. Every step introduces the risk of errors that ripple into downstream financial reporting, compliance issues and ultimately, delayed decision-making.

Beyond lost time, the opportunity cost is steep. Manual tasks absorb resources that could be focused on higher-value financial operations such as cash flow forecasting, optimizing the close process or strengthening internal controls. Finance teams are left addressing bottlenecks instead of driving strategic insights. When journal entries aren’t automated, organizations struggle with slower cycle times, limited scalability and increased audit risk. The true cost isn’t just in labor, but it’s also in missed opportunities, operational drag and the inability to support a faster close. For finance leaders aiming to modernize accounting processes, eliminating manual intervention is not just a nice-to-have — it’s a strategic imperative.

What is a journal entry?

A journal entry is the foundational record in accounting that documents the financial impact of business transactions. It typically includes debits and corresponding credits that update an organization’s ledger(s). Each entry plays a critical function in maintaining accurate financial records and supports the preparation of key financial statements like the balance sheet and income statement. Journal entries also require supporting documents to validate the transaction’s purpose, amount and timing in functions like accounts receivable, expense accruals and intercompany reclassifications. They are essential to sound bookkeeping and internal controls that support transparency and audit readiness.

In traditional accounting processes, journal entries are manually created, reviewed and posted, which introduces the manual effort, risk of errors, bottlenecks and inconsistencies in financial reporting. This manual intervention makes it harder for finance teams to ensure accuracy, especially during high-volume periods like the close process. As businesses grow, the complexity of managing journal entries in disparate accounting software or spreadsheets becomes increasingly unsustainable. Modern solutions like Finance Automation by Redwood help accounting teams shift away from manual, reactive and time-consuming routines to more controlled, scalable and efficient journal entry management. When journal entries are automated, finance leaders gain confidence in data integrity and more time for higher-value analysis.

What are the best features of a journal entry?

An effective journal entry captures the essence of financial activity with clarity and precision. Its core components — accurate debits and credits, alignment with the chart of accounts and traceable supporting documents — help ensure financial integrity and auditability. A well-structured journal entry supports internal controls by documenting the “who, what and why” of each transaction. It also ties into key accounting software systems to reflect real-time activity across financial operations. Especially for adjusting and recurring entries like accruals, allocations and amortizations, consistency and control are critical features that safeguard the accuracy of financial statements and compliance reporting.

When supported by automation or modern tools like Finance Automation by Redwood, journal entries become even more powerful. Finance Automation can enforce validations, reduce discrepancies and flag missing data before posting. It optimizes the journal entry process by eliminating manual data entry and integrating workflows across systems. This not only reduces the risk of errors but also enhances transparency for accounting teams and approvers. With automation, journal entries become a source of control and efficiency, rather than a bottleneck, within the close process. Finance and accounting teams gain the ability to scale entries, enforce review protocols and accelerate approvals, all while maintaining the integrity of their financial reporting.

Letting go of the ledger: How automation gives accountants more power

What are the benefits of journal entry automation?

Journal entry automation delivers transformative benefits for finance and accounting teams looking to streamline their close process and elevate their impact. By reducing manual intervention and eliminating time-consuming manual tasks, automation solutions like Finance Automation by Redwood enable faster, more accurate financial reporting. Teams no longer need to rely on Excel or repetitive data entry to post journal entries because automation handles the workflow, validation and audit trails with precision. This shift not only decreases the risk of errors and discrepancies in financial records, but it also eliminates rework, strengthens internal controls and compliance across financial statements.

Beyond efficiency, automation frees up finance and accounting professionals to focus on higher-value activities such as analyzing variances, optimizing cash flow or improving forecasting accuracy. It resolves bottlenecks that typically slow down month-end close and enables a faster close and better visibility into financial operations. Journal entry automation software can also integrate directly with existing accounting software, which reduces silos and standardizes entries across entities, departments and global regions. For organizations committed to improving accounting processes and modernizing finance, journal entry automation isn’t just a feature. It’s also a strategic lever for speed, accuracy and scalability.

Manual to magic: Agile automation for closing journal entries, account reconciliations and more