Blog & Newsroom

Featured Blogs

-

-

Product knowledge

Product knowledgeThe observable enterprise: Navigating complexity in workload automation

-

-

Latest Content

-

Analyst research

Analyst researchSOAP platforms in the wild: Top 5 use cases

Service Orchestration and Automation Platforms (SOAP) unify fragmented silos to support the five critical Use Cases defined in the 2025 Gartner Critical Capabilities report. See how orchestrating IT workloads, data and DevOps pipelines empowers you to scale automation without increasing operational complexity.

-

Finance automation

Finance automationToo many tools, not enough automation: How finance became a graveyard of SaaS

Rethink your tech stack by identifying how fragmented point solutions create more problems than they solve. Discover how a platform-first automation strategy delivers real execution across finance instead of more tools to manage.

-

3-S

3-SYour success, our gratitude: Celebrating Redwood customer voices of 2025

Global enterprises using Redwood Software solutions have achieved results like 86% faster financial closes and saving 45,000 hours per year. See what some Redwood customers achieved in 2025 and how your organization can follow suit.

-

AI (Artificial Intelligence)

AI (Artificial Intelligence)Before agentic AI: The foundation every enterprise needs

Establishing a unified orchestration layer creates the secure foundation required to move from basic automation to advanced agentic AI. Learn how integrating governance and visibility today will empower your organization to scale intelligent operations safely and consistently.

-

Analyst research

Analyst researchThe business case for a modern SOAP: Where Critical Capabilities deliver real ROI

Build a credible business case for Service Orchestration and Automation Platforms (SOAP) using the 2025 Gartner® Critical Capabilities for SOAP report. Map five operational Use Cases directly to your P&L to drive resilience, agility and verifiable ROI.

-

Product knowledge

Product knowledgeAI that delivers: Redwood RangerAI now available in RunMyJobs

Now available in RunMyJobs by Redwood version 2025.4, Redwood RangerAI empowers you to accelerate automation development and operations through AI-driven capabilities embedded directly into the platform. Generate scripts automatically, resolve errors instantly and scale your enterprise efficiently and securely with built-in governance.

-

Analyst research

Analyst researchSelf-driving automation: The leap from cruise control to true orchestration

Moving from isolated task automation to true enterprise orchestration requires a strategic evolution similar to the shift toward autonomous vehicles. Discover the five stages of maturity automation maturity and how to advance your operations toward intelligent, service-centric outcomes.

-

SAP

SAPSAP clean core and SAP Cloud ERP: Technical debt prevention with strategic orchestration

Enterprises adopting SAP Cloud ERP, formerly known as SAP S/4HANA Cloud, or modernizing through RISE with SAP share a common goal: moving faster without losing control.

-

Finance automation

Finance automationFrom checklists to automation: Why your close management is still manual

A close management system is only as good as the automation it enables. Get real-time visibility into your tasks.

-

Analyst research

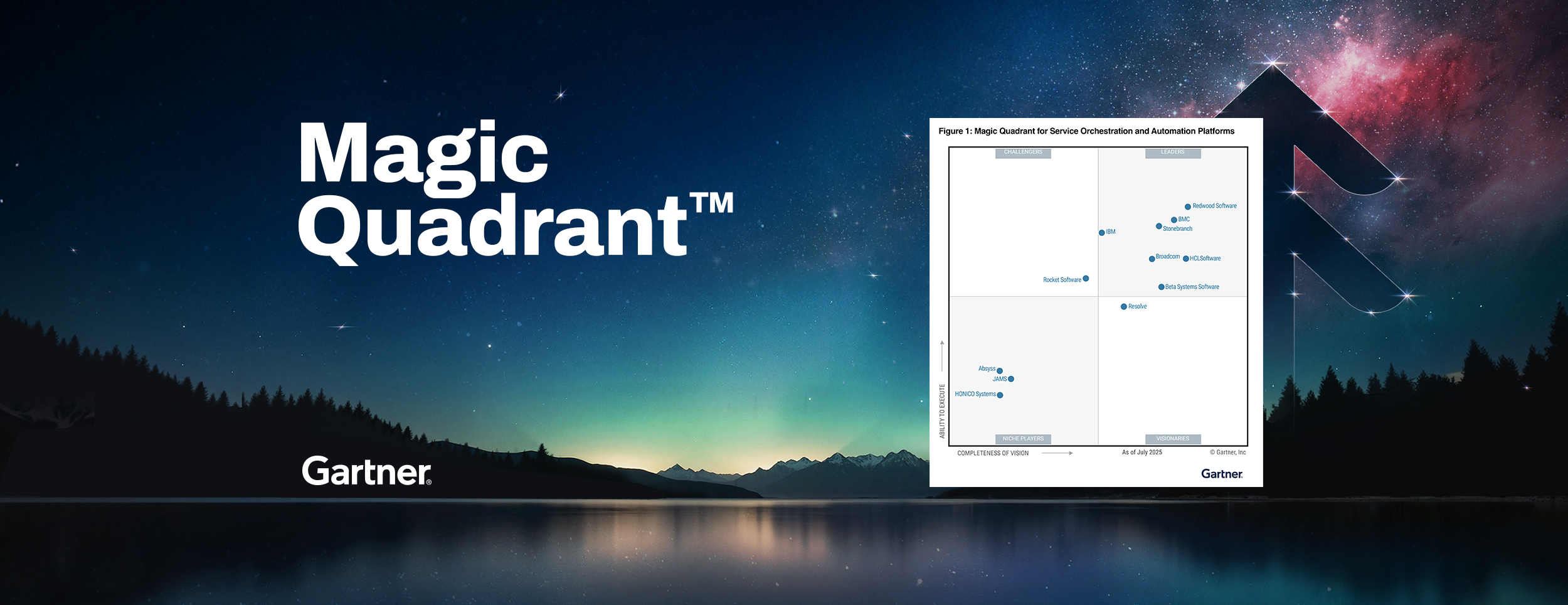

Analyst researchBeyond the dot: A strategist’s guide to the 2025 Gartner® Magic Quadrant™ for SOAP

Look beyond a vendor's dot on the Gartner® Magic Quadrant™ for Service Orchestration and Automation Platforms to understand the true strategic value of the report. Learn how to interpret the Ability to Execute and Completeness of Vision axes to make smarter, long-term automation investments.

-

Analyst research

Analyst researchThe new rules of enterprise orchestration platforms

See why your legacy automation tools may struggle to manage modern hybrid cloud complexity and put business outcomes at risk. Learn the new rules defining modern orchestration platforms, from event-driven design to AI enablement.

-

Cloud

CloudWhat cloud modernization delivers — and why it’s the new standard

Understand why cloud modernization has shifted from simple migration to a new standard for business operations. Learn how aligning technology with core processes drives resilience, optimizes costs and creates a foundation for innovation.

-

AI (Artificial Intelligence)

AI (Artificial Intelligence)The next evolution of enterprise automation: Introducing Redwood RangerAI

Discover the next evolution of enterprise automation with Redwood RangerAI, a new suite of AI capabilities designed to combat modern operational friction. See how integrated assistants can help your teams learn faster, troubleshoot issues and scale smarter automation with greater confidence.

-

Cloud

CloudStill running automation on-prem? Cloud-first might be your next best move

Running workload automation on-prem can limit your ability to scale and adapt in today's hybrid and multi-cloud environments. Discover how a cloud-first strategy provides greater agility and resilience, helping you modernize operations without replacing your existing systems.

-

Product Pulse

Product Pulse9 signs it’s time to embrace SaaS workload automation

Learn how legacy workload automation can limit your ability to scale operations and innovate, even when daily processes seem to run smoothly. Discover nine clear signs your organization is ready to modernize and how a SaaS platform prepares you for future growth.

-

Finance automation

Finance automationThe unseen burden: Why your “automated” journal entry process is still manual

More than half of the typical month-end close depends on journal entries. But for most finance and accounting teams, “automation” still means entering numbers into Excel templates, attaching supporting documents and emailing approvals because manual work is hidden behind a polished user interface. It doesn’t have to be this way though. Finance Automation by Redwood eliminates manual journal entries entirely. It integrates with your ERP systems, orchestrates every step in the journal entry process and removes human intervention from data sourcing,

-

Digital transformation

Digital transformation40% of automation teams aren’t ready for AI — Here’s what they’re missing

Despite increased spending on automation, nearly 40% of teams admit they aren't ready to implement AI. Learn what the most mature organizations do to prepare their systems and processes for successful AI adoption.

-

Analyst research

Analyst researchThe SOAP superpower: Why extensibility defines future-readiness for the enterprise

The Service Orchestration and Automation Platform (SOAP) market has expanded fast. In parallel with that growth, vendors have been vying for Leader positions in the Gartner® Magic Quadrant™ for SOAP since 2024. But with feature lists that sound nearly identical, it can be hard to tell which solutions truly enable end-to-end orchestration across complex enterprise environments. One way to tell is to look at integration. The best SOAPs aren’t just job schedulers with APIs.

-

Analyst research

Analyst researchYour SOAP scorecard, inspired by Gartner® Critical Capabilities

Evaluate Service Orchestration and Automation Platforms (SOAPs) with a scorecard inspired by Gartner’s® Critical Capabilities for SOAPs report. Apply this practical framework to assess vendors against your specific business priorities and select the best solution for your needs.

-

Product Pulse

Product PulseGuide to choosing the right SOAP solution

Get a practical framework for selecting the right Service Orchestration and Automation Platform (SOAP) for your enterprise. Learn how to evaluate vendors on critical criteria like scalability, hybrid orchestration and AI-powered productivity to make a strategic decision.

-

SAP

SAPHow automation fabrics protect SAP forecasting and replenishment from failure

Forecasting and replenishment (F&R) looks straightforward to the customer but is a complex production with dozens of systems, processes and dependencies behind the scenes. Explore why even the best demand forecasts fail without orchestration and how an automation fabric can save your supply chain.

-

Finance automation

Finance automationThe illusion of progress: Why “automated” finance tools still run on human duct tape

Finance teams aren’t lacking in activity. From bookkeeping, journal entries and invoice processing to reconciliations and reporting, there’s always something in motion. Yet despite all the hustle, progress often feels out of reach. The real problem? Manual work hasn’t disappeared; it’s just been reshuffled into bottlenecks that delay more strategic work. In many cases, automation efforts have only shifted time-consuming accounting and finance tasks from one format to another. A spreadsheet becomes a shared dashboard. An email approval becomes a routed task.

-

Analyst research

Analyst research2025 Gartner® Critical Capabilities for SOAP: Redwood Software ranks first in all 5 Use Cases

Service orchestration and automation platforms empower heads of I&O to orchestrate end-to-end business services, expanding beyond traditional workload automation. This research can help heads of I&O choose the SOAP that best fits their needs.

-

Analyst research

Analyst researchRedwood Software named a Leader two years in a row: 2025 Gartner® Magic Quadrant™ for SOAP report

Discover why Redwood Software was named a Leader in the 2025 Gartner® Magic Quadrant™ for Service Orchestration and Automation Platforms (SOAP) for the second consecutive year. Gain insights into the evaluation criteria and see why Redwood was positioned furthest for Completeness of Vision and highest for Ability to Execute.