Jabil reveals 4 benefits of digitizing the financial close process

Global manufacturing services company Jabil achieved four major benefits by automating and digitizing manual tasks across its month-end close and record-to-report (R2R) process.

Using Finance Automation by Redwood, Jabil achieved:

- Time savings

- Standardization

- Data quality

- Reduction in potential audit fees

Speaking in a recent webinar with sharedserviceslink, Scott Barone, director of the finance digital PMO at Jabil, explained that the automation project started by surveying finance teams across both the corporate and individual site functions globally, identifying their pain points and the most repetitive manual processes. This included conducting time studies, four-fields mapping and a data quality analysis across Jabil’s close processes.

The findings revealed a significant amount of manual work for finance teams in the collection and preparation of data every month. They also identified a lack of standardization, as each site within the Jabil group executed these close processes slightly differently.

Thanks to the study, Barone and his team were able to prioritize a list of finance processes that were ripe for standardization and automation. Balance sheet certification, as one of the most manual processes in its month-end close, was the ideal starting point.

The manual process for balance sheet certification required a financial analyst to go into SAP, execute a particular transaction code (T-code), pull all that data down into a spreadsheet, analyze the data, send the data via email to a controller to get it certified and then go back and forth with any changes.

By automating balance sheet certification with Finance Automation, Jabil saved, on average, five hours during the time-sensitive, four-day monthly close cycle for each of its 100-plus company codes within the Jabil group. Enhanced dashboard capabilities are also being implemented that will further increase those time savings.

“Any time savings there are instrumental to being able to get your books closed quickly,” explains Barone. “Taking five hours out of that [four-day] window [for each company code] is huge and it helps our sites meet our deadlines and work.”

Standardization is another benefit of the project. “Everybody did things a little differently,” he says. “Through this, we were able to standardize the process, and that standardization actually gives us a lot better quality of data.”

He also stressed that the aim of automation at Jabil is not headcount reduction in finance: “It’s repurposing and better utilization of our resources. It’s freeing up time from these mundane, repetitive, manual tasks to allow them to actually do the deep analysis. It allows the folks to do what they really need to do.”

In the webinar, Shak Akhtar, SVP of Finance Automation at Redwood, highlighted an Institute of Management Accountants (IMA) survey that shows 80% of finance professionals are not satisfied with their close and that 66% still rely heavily on spreadsheets, which increases manual effort, time and risk in the close.

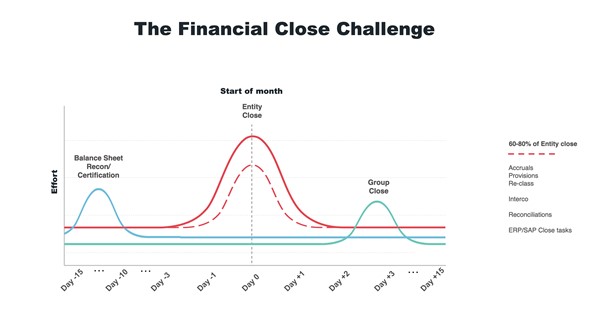

Akhtar also cited Redwood’s own survey, which identified exactly where the finance team’s time and effort is spent during the month-end close. This survey shows that it is not reporting, as is widely believed, but actually accruals, provisions and reclassification of journals — followed by reconciliations and intercompany.

Essentially, the bulk of finance’s effort and time is spent on the entity close stage — closing the books for each of the group’s individual entities and businesses — and not at the group close and reporting stage.

How can organizations flatten this entity close spike and accelerate their close? Akhtar explained that 50% of the entity close work is around journal entry — accruals, provisions and reclassification — and that most or all of this can be automated.

“Redwood does all the preparation work — going into the HR system, going into the payroll system, extracting the information, doing the calculation, seeking approval — and, based on that, doing the posting of the journal,” he says. “The entire thing becomes 100% automatable.”

The ultimate goal is to have the automation actually do the entire close and make it a non-event for finance teams. “We are trying to drive automation so that your close will just happen, meaning that Redwood will perform the close,” says Akhtar.

The ultimate goal is to have the automation actually do the entire close and make it a non-event for finance teams. “We are trying to drive automation so that your close will just happen, meaning that Redwood will perform the close,” says Akhtar.

Webinar panelist Tim Sheridan, managing partner at consultants Connected Insight, explained how organizations can start their automation projects, build a business case for the project and ensure it maintains momentum and doesn’t just grind to a halt.

The key to getting started, he said, is using data and analytics to build a business case around the business impact. For example, ask if that’s about reducing transactional costs. Or is it about shifting finance’s focus to driving more business value? Then look at the primary drivers to achieve those goals — such as staffing levels, the percentage of activities completed on time or error rates.

“Be data-driven,” Sheridan advises. “Analyze your processes, your current efficiency, what your organization is focused on and use that to support your targets, supported by performance benchmarking. Internally benchmark — whether that’s by country, region or entity. Who is leading, who is lagging, what’s the gap?”

Jabil is also in the process of moving to the cloud version of Redwood’s finance automation platform. “We spend a good deal of time taking care of servers and infrastructure and things like that which need to be done behind the scenes to keep the tool up and running,” Barone says. “By moving to the cloud, that will free up a lot of our time and allow us to put that burden on Redwood and have them manage everything in the cloud for us.”

And, based on the success of the balance sheet certification automation project, Barone said Jabil will also start automating manual journal entry, subledger and then intercompany.

“We are constantly looking at ways to streamline, to standardize and to automate our manual processes,” explains Barone. “We continue to evolve. We automate where it makes sense. As part of that automation, we also standardize our processes, we make sure our data is clean and we get our house in order. Then, we do the standardization and change management and the deployment.”

Watch the on-demand webinar now: 4 benefits of digitizing the financial close process at Jabil

Blog: Automation lessons from the financial close front line

About The Author

Darrell Maronde

Darrell Maronde is the Senior Product Marketing Manager for Redwood’s workload automation solutions. He has more than 15 years of product marketing experience with on-prem and SaaS software, including solutions for IT and operations.