Blog & Newsroom

Featured Blogs

-

Product knowledge

Product knowledge -

-

-

Managed file transfer

Managed file transferMeeting MFT security, reliability and compliance requirements with JSCAPE

Latest Content

-

SAP

SAPBridging R&D and clinical operations with frictionless SAP data pipelines

Disconnected SAP data hinders the potential of AI in life sciences, delaying drug discovery and clinical operations. Intelligent data orchestration provides a solution by creating frictionless pipelines that connect R&D and clinical processes, enabling efficient data flow for advanced analytics and regulatory compliance.

-

Finance automation

Finance automationManual to magic: Agile automation for closing journal entries, account reconciliations and more

Revolutionize your financial close process by embracing agile automation for journal entries, account reconciliations and more key steps. Use this practical guide to transform tedious tasks into streamlined, efficient workflows through focused sprints and tangible wins.

-

Finance automation

Finance automationWhen the real work begins: Maximize finance automation ROI

Unlock the full potential of your recent digital transformation by strategically empowering your Finance team to move beyond routine tasks and become true business partners. Learn actionable strategies to redefine the function’s role and drive significant business value.

-

Product Pulse

Product PulseAnalytics in motion: Incorporating SAP Analytics Cloud into complex process cadences

To truly impact business outcomes, analytics must be seamlessly integrated into operational processes, moving beyond isolated dashboards. SAP Analytics Cloud, when orchestrated with a workload automation platform, enables analytics to align with your business rhythms, ensuring timely insights are delivered within complex processes so they drive informed decisions.

-

SAP

SAPMeter to money: Automating the data journey behind every bill

Every utility bill hinges on a complex data journey that begins with meter readings and culminates in revenue recognition. Explore how automating and orchestrating this process, especially within SAP-centric environments, is crucial for efficient operations and cash flow and consistent customer satisfaction, particularly when facing fluctuating energy demands and evolving grid modernization demands.

-

Support & success

Support & successCulture of curiosity: How software champions lead the charge on automation

Ignite your team's efficiency and your own career by embracing the power of continuous software learning, especially with automation platforms. Becoming a "learning champion" fosters a culture of proactive knowledge sharing, leading to increased productivity and stronger organizational impact.

-

Product knowledge

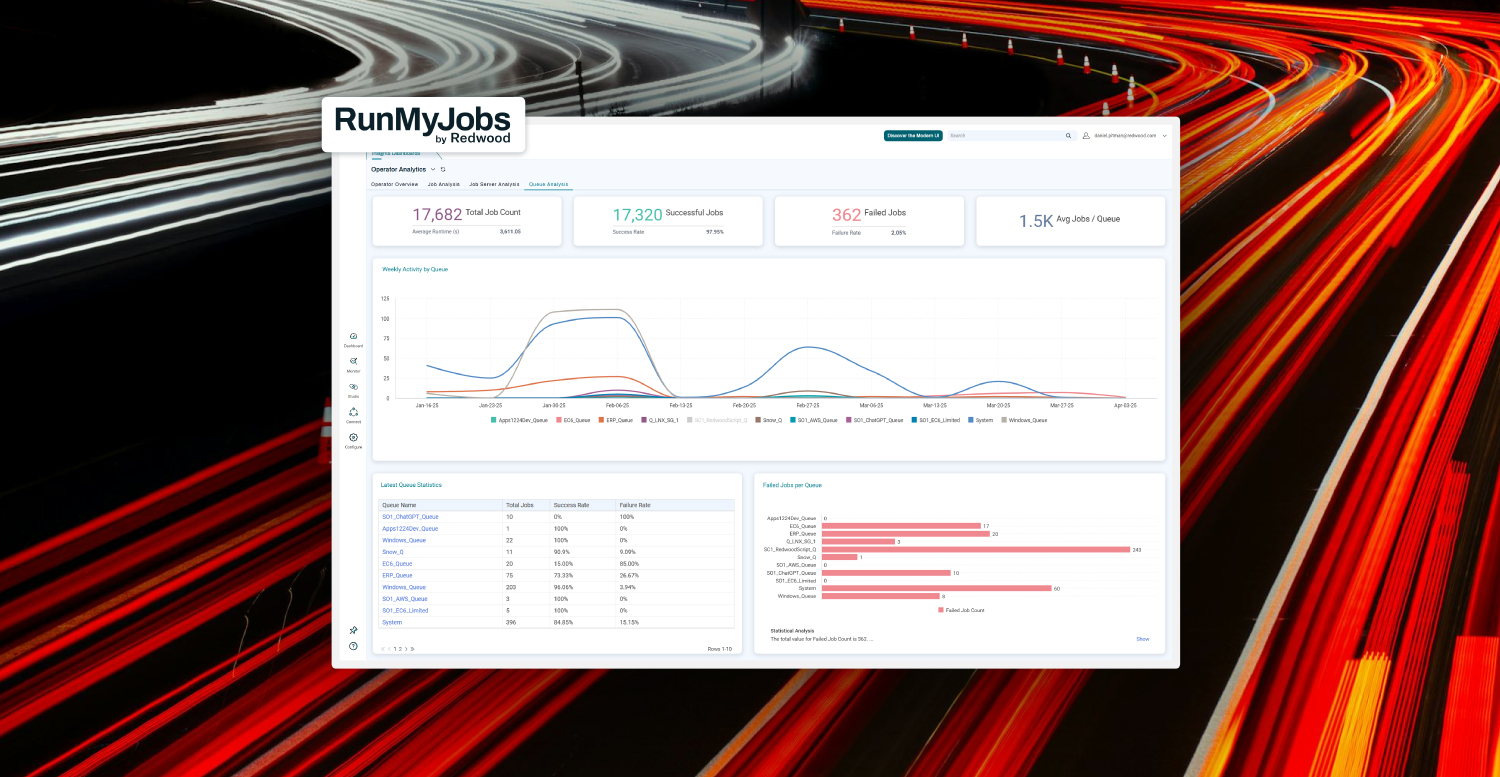

Product knowledgeThe observable enterprise: Navigating complexity in workload automation

Gain complete control over your complex automation landscape by embracing observability principles using workload automation and SOAP platforms. Use the newly released add-on to RunMyJobs by Redwood, Redwood Insights, for unprecedented visibility, issue resolution and decision-making.

-

SAP

SAPThe automation fabric symphony: Harmonizing SAP data for precision manufacturing

Disconnected manufacturing data can hinder your Industry 4.0 goals. A unified automation fabric powered by SAP orchestration can harmonize your data, analytics and decisions to help you achieve precision manufacturing and a competitive edge.

-

SAP

SAPResilience in retail: How to move your SAP data to minimize waste

Minimize waste and lost revenue in your retail operations by transforming your SAP data management with proven supply chain strategies. Orchestrate disparate data sources, gain end-to-end visibility and develop an automation fabric for responsive forecasting and replenishment to maximize efficiency and profitability.

-

Managed file transfer

Managed file transferFile transfer strategy for RISE with SAP: Clean core, compliance and control

Establishing a robust file transfer strategy for large and high-volume transfers during your RISE with SAP transformation can help you adhere to clean core principles and ensure compliance down the road. Integrate workload automation with a dedicated MFT solution to simplify these transfers in your hybrid SAP environment.

-

Finance automation

Finance automationRethinking finance tech: People, projects and purpose

If you’re frustrated by underperforming finance technologies, it’s time to reevaluate your approach by prioritizing people and processes over the allure of plug-and-play solutions. Find out how to incrementally implement automation to achieve meaningful and lasting finance transformation.

-

SAP

SAPEscape the data maze: Your SAP data journey from source to insight

Tired of SAP data silos, inconsistent reporting and missed opportunities? Discover how a purpose-built orchestration layer can unify your SAP and non-SAP systems, automating data flow and providing real-time insights to drive better decisions and future-proof your enterprise.

-

Finance automation

Finance automationThe 33%: What finance leaders know but aren’t implementing

Despite 91% of finance leaders acknowledging the potential for R2R automation, only 58% have implemented it, highlighting a significant gap between awareness and action. Barriers like legacy system integration and perceived high costs necessitate a strategic, holistic approach to overcome the 33% implementation deficit and realize the full ROI of automation.

-

Finance automation

Finance automationR2R reality check: Research shows automation lags despite demand

Despite overwhelming agreement among finance leaders that automation is crucial for efficient record-to-report (R2R) processes, research reveals a significant gap between this perception and the actual implementation, with many organizations still relying on manual efforts. Explore the reasons behind this lag and access the full report.

-

SAP

SAPAutonomous SAP production planning — Produce more faster and maintain quality

Disconnected systems and manual processes are crippling modern manufacturing, leading to production delays, increased costs and quality issues. Intelligent orchestration with advanced workload automation complementing your SAP solutions offers you a coordinated framework that connects and synchronizes your data, processes and systems.

-

Redwood Software

Redwood SoftwareIntroducing Redwood’s AI assistant: Instant answers, easier automation

Redwood Software’s new AI assistant delivers instant, conversational answers to your questions about Redwood products. Get faster troubleshooting and boost your productivity with this intuitive tool.

-

Finance automation

Finance automationMore software won’t save you: Change management advice for finance

Discover how change management can drive automation success for your financial transformation and get advice for your finance automation journey.

-

Finance automation

Finance automationStreamlining reclassifications for financial accuracy

Manual financial reclassification processes are time-consuming and error-prone, leading to potential misstatements and prolonged month-end close cycles. Automate these processes to find cost savings, improve accuracy, enhance scalability and drive faster close cycles, ultimately enabling your finance teams to focus on higher-value analysis.

-

Finance automation

Finance automationLetting go of the ledger: How automation gives accountants more power

Automation is transforming accounting, shifting the focus from tedious manual tasks to analysis and higher-level decision-making. By embracing automation as an accountant, you can gain greater control over your work and career and become a strategic advisor, providing more valuable insights that drive business success.

-

Finance automation

Finance automationThe power of automation in managing accruals and provisions

Automation is revolutionizing accruals and provisions management, replacing error-prone manual processes with streamlined, accurate systems. Find out how this shift enhances financial reporting accuracy, ensures compliance with regulations and provides real-time insights for better decision-making.

-

Finance automation

Finance automationRipple effects of finance transformation: 7 real-world stories

Learn how finance transformation helped four industry leaders automate operations, reduce inefficiencies, and drive strategic growth. Discover insights and how finance automation can help your organization.

-

Redwood Software

Redwood SoftwareThe Fortune 50’s secret weapon: Who is Redwood Software?

Redwood Software began as a small team with a vision to connect IT processes to critical business functions and evolved from a startup to an industry shaper in automation. Read the story of how Redwood overcame significant challenges across three decades to pioneer SaaS automation, cloud-native solutions and a broader approach beyond IT-centric workflows, now serving 40% of Fortune 50 companies.

-

SAP

SAPASUG’s SAP BTP findings reveal new pathways to ROI with Redwood

ASUG's latest report highlights the growing adoption of SAP BTP, with a majority of users prioritizing integration, analytics and automation and looking ahead to ways to incorporate AI. To maximize your ROI and navigate the complexities of SAP BTP, consider how you could accelerate your innovations with RunMyJobs by Redwood.

-

Managed file transfer

Managed file transferMFT solutions bring compliance gold to high-stakes industries

Managed file transfer (MFT) solutions are the gold standard for compliance in regulated industries due to their built-in security controls, automation and audit capabilities. Learn the risks of using obsolete solutions and why upgrading is essential for building operational resilience and avoiding the costly consequences of data breaches and non-compliance.